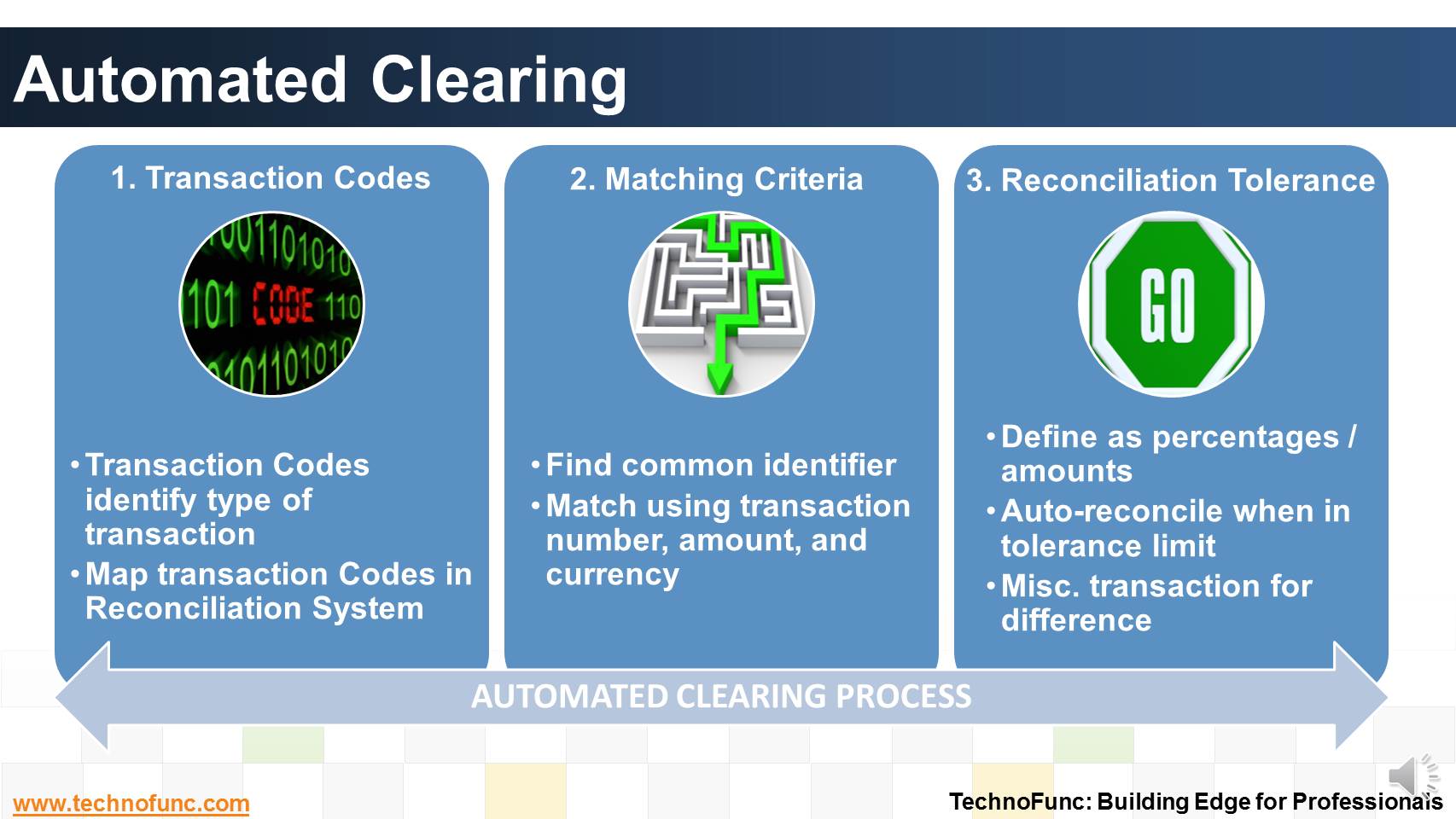

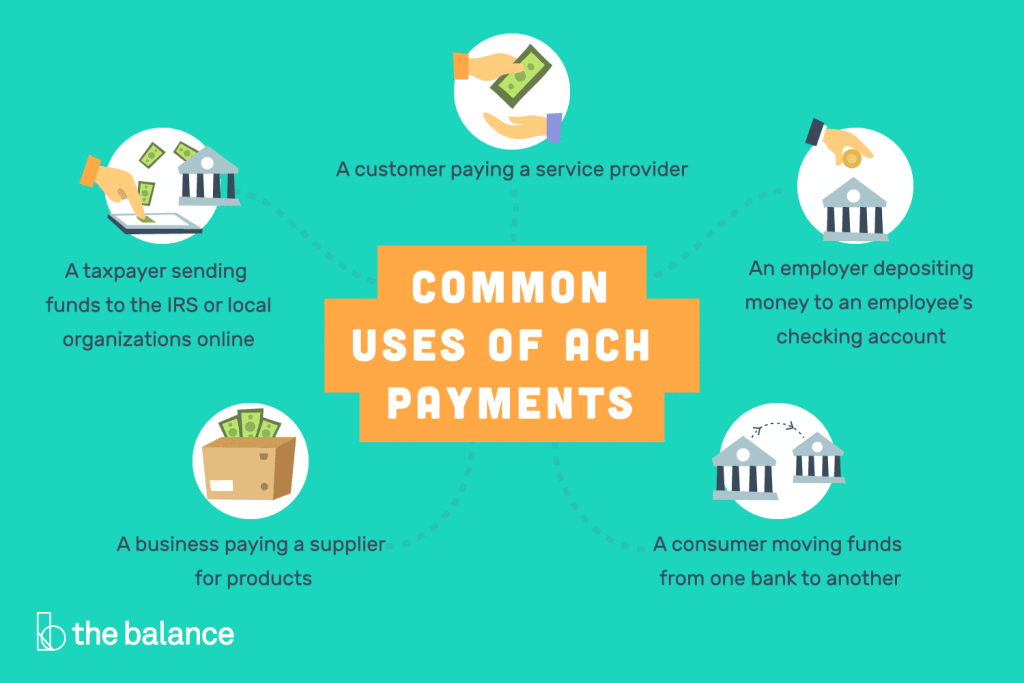

Bank Automated Clearing System. The account is widespread in the United Kingdom due to the advantages it brings but has also been widely criticized for the rather slow processing time. The automated clearinghouse (ACH) system is a nationwide network through which depository institutions send each other batches of electronic credit and debit transfers.

ACH (Automated Clearing House) is a network used for electronically moving money between bank accounts across the United States.

Related to Bankers Automated Clearing Services: Bankers Automated Clearing System.

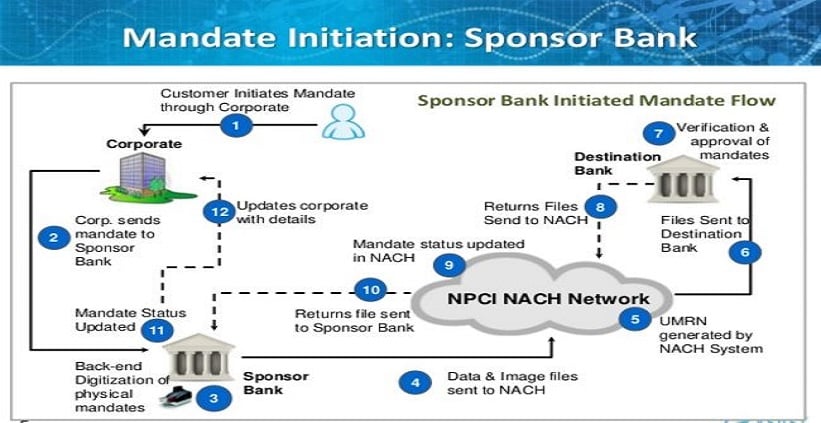

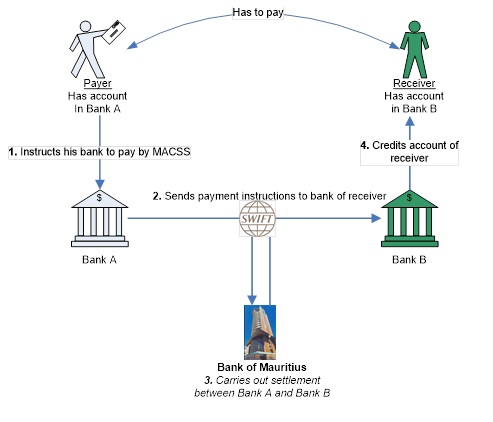

The Clearing House Automated Transfer System, or CHATS, is a real-time gross settlement (RTGS) system for the transfer of funds in Hong Kong. The newly introduced centralised payment/transaction processing system by the National Payments Corporation of India (NPCI), National Automated Clearing House (NACH), has been implemented for banks, corporates, financial institutions and the Government. NACS is used to describe the automated clearing system of the entire banking and financial industry for both electronic instruments (ACH) and derivatives/images paper-based instruments (cheques).

.png)

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)